Financial institutions participate in which of the following activities?

A. indirect finance

B. financial intermediation

C. the issuance of loans

D. all of these

Answer: D

You might also like to view...

Assume a reserve requirement of 10 percent. A commercial bank has total reserves of $100,000, excess reserves of $25,000, and total checkable deposits outstanding of $750,000. If the reserve requirement were increased to 15 percent,

a. total expansion of the money supply would be limited to $750,000. b. excess reserves would be decreased to $12,500. c. the bank would have no alternative but to decrease its check able deposits. d. the bank would be $12,500 short of required reserves.

From a firm's viewpoint, opportunity cost is the

A) best alternative use customers can find for the firm's output.

B) cost the firm must pay for the factors of production it employs to attract them from their best alternative use.

C) accounting cost of resources.

D) price a firm can charge for its output.

E) cost of acquiring the opportunity to sell to its customers.

Suppose a price ceiling is set above the equilibrium price. Now suppose that policy makers decide to raise the price ceiling. This increase in the price ceiling will cause which of the following to occur?

A) The surplus in the market will increase. B) The surplus in the market will decrease. C) The shortage in the market will increase. D) none of the above

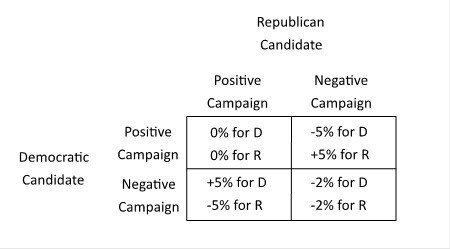

The table below shows how the payoffs to two political candidates depend on whether the candidates run a positive or negative campaign. The payoffs are given in terms of the percentage change in the number of votes received.  In the Nash equilibrium of this game:

In the Nash equilibrium of this game:

A. one candidate runs a positive campaign, and the other runs a negative campaign. B. both candidates run negative campaigns. C. both candidates run positive campaigns. D. as long as one party runs a positive campaign, the other does too.