According to the efficient markets theory of stock prices,

a. fundamental analysis is a way to profit from predicting stock prices

b. fundamental and technical analysis are largely useless

c. technical analysis is the best approach to profit from predicting stock prices

d. fundamental and technical analysis must be synthesized in order to profit from predicting stock prices

e. whether fundamental and technical analysis can be profitable depends on the specific firm being analyzed

B

You might also like to view...

Based on Table 4.1, according to the Stolper-Samuelson Theorem, the income distribution effects of free trade in the United States are likely to favor

A) capital. B) labor. C) either capital or labor, depending on U.S. productivity. D) neither capital nor labor. E) Not enough information to tell.

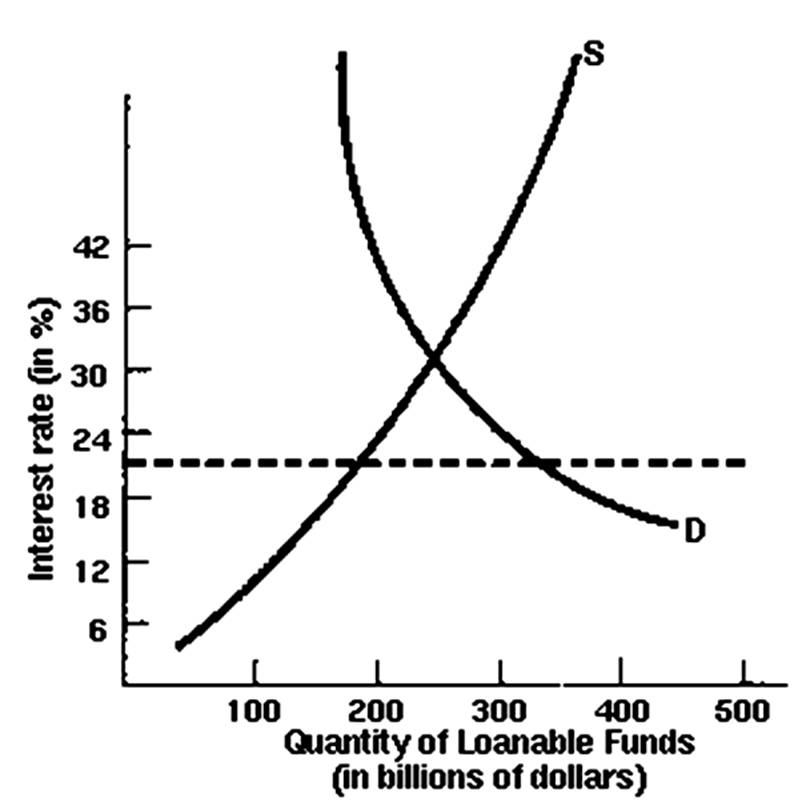

If the usury law set the interest rate ceiling at 21%, how much of a shortage of loanable funds would there be?

If the United States raises tariffs on foreign goods, it may achieve

A. Higher production possibilities. B. Greater profitability of import-competing firms. C. Higher efficiency in domestic production. D. Higher U.S. exports.

For a given domestic and foreign price level, an increase in the nominal exchange rate ________ the real exchange rate.

A. may either increase or decrease B. increases C. decreases D. offsets any change in