What are the infant industry and dumping arguments for protection? Are they correct?

What will be an ideal response?

The attempt to stimulate the growth of new industries is the infant-industry argument for protection, which states that it is necessary to protect a new industry from import competition to facilitate the growth of that industry, making it competitive in the world markets. This argument is based on the concept of dynamic competitive advantage. Learning-by-doing is a powerful engine of productivity growth. However the learning-by-doing argument for protection only works if the benefits also spill over into other industries and other parts of the economy. This is rarely the case, as the entrepreneurs of infant industries and their financial supporters take this risk into account and all returns usually accrue only to them, not to other industries. And it is more efficient to subsidize the infant industry needing protection than it is to protect it by restricting trade.

The dumping argument for protection states that a foreign firm is selling its exports at a lower price than its cost of production. Foreign firms trying to monopolize the international market may use this practice. Once the competition is gone, the foreign firm will raise prices and reap profits. This argument fails for several reasons. First, it is virtually impossible to detect the occurrence of dumping since it is impossible to verify a firm's production costs. The test most commonly used is if the export price is lower than the import price. This test only examines the supply side of the two markets and ignores the demand side. If the domestic market is inelastic and the export market is elastic (which is almost always the case) then it is natural for a firm to price the domestic goods higher than the exports. Second, it is difficult to see how a global firm could have a monopoly for the goods or services it exports. There are too many foreign suppliers (and potential suppliers), making global competition too extensive for a monopoly to exist in the global market. And, even if there is global monopoly it is more efficient to regulate it than to impose trade restrictions on its products.

You might also like to view...

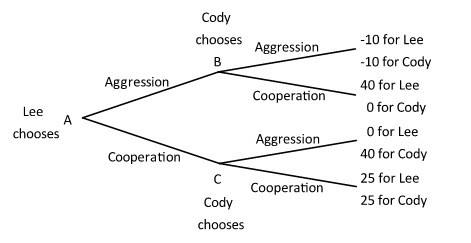

Lee and Cody are playing a game in which Lee has the first move at A in the decision tree shown below. Once Lee has chosen either aggression or cooperation, Cody, who can see what Lee has chosen, must choose either aggression or cooperation at B or C. Both players know the payoffs at the end of each branch.  If Lee chooses aggression, Cody will respond with ________, and if Lee chooses cooperation, Cody will respond with ________.

If Lee chooses aggression, Cody will respond with ________, and if Lee chooses cooperation, Cody will respond with ________.

A. aggression; aggression B. cooperation; aggression C. cooperation; cooperation D. aggression; cooperation

Air fares are generally lower on Tuesdays and Wednesdays each week. What is a likely explanation for this occurrence?

A. Supply is relatively variable, and lower demand on these days leads to a lower equilibrium price. B. Demand is relatively variable, and lower supply leads to a lower equilibrium price. C. Lower levels of both supply and demand on these days lead to a lower equilibrium price. D. Supply is relatively fixed, and lower demand on these days leads to a lower equilibrium price. E. Demand is relatively fixed, and lower supply leads to a lower equilibrium price.

Until the early 1980s, The Walt Disney Company used a pricing strategy in which visitors to its theme parks paid a low admission fee and also paid for rides. This pricing strategy is an example of

A) a two-part tariff. B) perfect price discrimination. C) cost-plus pricing. D) monopoly pricing.

The Dow Jones Industrial Average:

A. gives greater weight to shares with higher prices. B. gives equal weight to a change in the price of the stock of any company in the index. C. is a value-weighted index. D. reflects that a 10% increase in a share of stock selling for $30 will have the same effect on the index as a 10% increase in the price of a stock selling for $60.