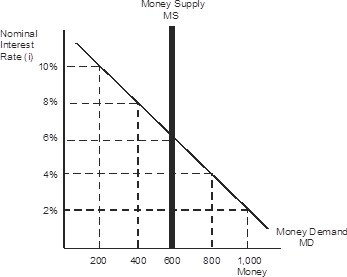

Refer to the figure below where the nominal interest rate equals 6% and the money supply equals 600. If the Federal Reserve wants to set the nominal interest rate at 10%, it must conduct open market ________ to set the money supply at ________.

A. sales; 200

B. sales; 800

C. purchases; 800

D. purchases; 200

Answer: A

You might also like to view...

Which of the following persons is hedging?

A) A commodity speculator who confines his purchases or sales to futures contracts B) A commodity speculator who confines his market activity to the purchase of futures C) A commodity speculator who confines his market activity to the sale of futures D) A farmer who buys September corn futures when he plants corn in May E) A farmer who sells September corn futures when he plants corn in May

If one dollar exchanges for 100 Japanese yen, then

a. a yen is worth $1 b. $10 will exchange for one yen c. a yen is worth $100 d. the United States gets 100 times the number of goods for its currency than does the yen e. one yen is worth a penny

How does competition from nonunion firms and foreign producers affect the ability of a union to increase the wages of its members?

a. Such competition reduces the ability of a union to achieve wage increases. b. Such competition does not affect the ability of a union to achieve wage increases. c. Such competition will increase the strength of a union if it produces a product sold in the domestic market but reduce the strength of the union if it produces an export product. d. The effect of this type of competition will be entirely dependent on the elasticity of demand for labor in the domestic market.

Which value is higher? a) $1,000 today or b) $10,000 in 20 years if the interest rate is 12%.

What will be an ideal response?