The existing tax rates on income in the United States:

A. curtail spending slightly when incomes rise because people have to pay more in taxes when incomes are high.

B. act as an automatic stabilizer.

C. encourage spending slightly when incomes fall because people pay less in taxes when incomes are low.

D. All of these are true.

Answer: D

You might also like to view...

The 1990 U.S. recession was

a. triggered by a negative supply shock b. characterized by falling wage rates as the economy began to correct itself c. relatively painless d. triggered by a negative demand shock e. characterized by disinflation

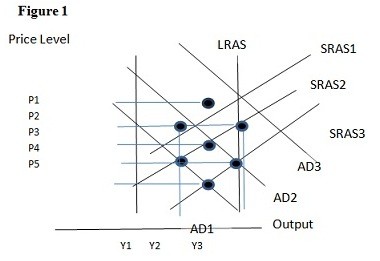

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y1. C. P3 and Y1. D. P3 and Y2.

Firms whose central business is providing individual account shares of a group of stocks, bonds, or both are known as:

A. insurance companies. B. thrifts. C. commercial banks. D. mutual funds companies.

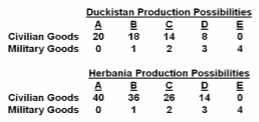

Refer to the tables. Opportunity costs are:

A. constant in both Duckistan and Herbania.

B. larger in Duckistan than in Herbania.

C. increasing in both Duckistan and Herbania.

D. increasing in Duckistan and constant in Herbania.