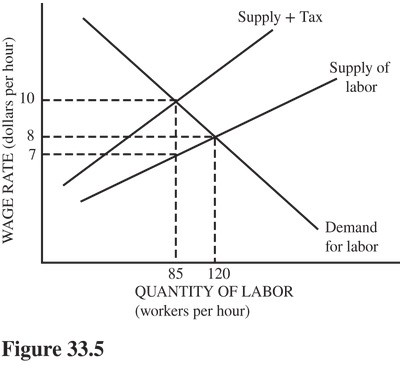

Refer to the labor market in Figure 33.5. Suppose the government imposes a payroll tax on employers. How much of the tax burden is passed on to workers?

Refer to the labor market in Figure 33.5. Suppose the government imposes a payroll tax on employers. How much of the tax burden is passed on to workers?

A. $8 - $7 = $1 per hour.

B. $10 - $7 = $3 per hour.

C. $7 per hour.

D. $10 - $8 = $2 per hour.

Answer: A

You might also like to view...

Which of the following statements is true?

A) The production possibilities curve of a nation is fixed in the long run. B) The production possibilities curve can only shift to the right. C) The production possibilities curve of an economy is concave to the origin. D) The slope of the production possibilities curve represents the ratio of the marginal cost of producing goods.

What three conditions must hold for a firm to successfully price discriminate?

What will be an ideal response?

Answer the following statements true (T) or false (F)

1. A major characteristic of a monopoly is the ability of the monopolist to influence price. 2. A monopolist must produce a good for which there are no close substitutes. 3. U.S. patents grant a lifetime monopoly on an invention. 4. Public utilities are often called natural monopolies. 5. No U.S. firm has ever obtained sufficient control over raw materials to develop a monopoly or near monopoly on that basis.

In the long run, increases in the money supply increase the economy's potential output level

a. True b. False Indicate whether the statement is true or false