If the CPI for 2008 was 112, the typical market basket purchased that year would cost

a. 12 percent more than the same market basket purchased the previous year

b. 112 percent more than the same market basket purchased the previous year

c. 12 percent more than the same market basket purchased in the base year

d. 112 percent more than the same market basket purchased in the base year

e. more than the same market basket purchased during any previous year

C

You might also like to view...

In Figure 3-6 above, income and planned expenditure are equal at

A) point J. B) point K. C) point L. D) all of the above.

Suppose that the MPC out of disposable income was 0.8 and the marginal tax rate was 0.25 for a given economy. In this case, the value of the tax multiplier in the simple Keynesian model would be

a. 1. b. -2. c. 2.5. d. 2. e. none of the above.

John is trying to decide whether to expand his business or not. If he continues his business as it is, with no expansion, there is a 50 percent chance he will earn $100,000 and a 50 percent chance he will earn $300,000. If he does expand, there is a 30 percent chance he will earn $100,000, a 30 percent chance he will earn $300,000 and a 40 percent chance he will earn $500,000. It will cost him $150,000 to expand. The difference in expected earnings if John chooses to expand versus not expand is:

A. $320,000. B. $200,000. C. $150,000. D. $120,000.

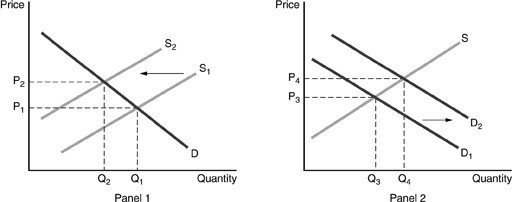

A shift from S1 to S2 reflects the change that happens when a negative externality is taken into account. A shift from D1 to D2 reflects the change that happens when a positive externality is taken into account.Refer to the above figures. A negative externality existed but has been corrected. Price and quantity will be

A shift from S1 to S2 reflects the change that happens when a negative externality is taken into account. A shift from D1 to D2 reflects the change that happens when a positive externality is taken into account.Refer to the above figures. A negative externality existed but has been corrected. Price and quantity will be

A. P1 and Q1. B. P2 and Q2. C. P3 and Q3. D. P4 and Q4.