Two firms, A and B, each currently emit 100 tons of chemicals into the air. The government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution emitted into the air. The government gives each firm 40 pollution permits, which it can either use or sell to the other firm. It costs Firm A $200 for each ton of pollution that it eliminates before

it is emitted into the air, and it costs Firm B $100 for each ton of pollution that it eliminates before it is emitted into the air. After the two firms buy or sell pollution permits from each other, we would expect that Firm A will emit

a. 20 fewer tons of pollution into the air, and Firm B will emit 100 fewer tons of pollution into the air.

b. 100 fewer tons of pollution into the air, and Firm B will emit 20 fewer tons of pollution into the air.

c. 50 fewer tons of pollution into the air, and Firm B will emit 50 fewer tons of pollution into the air.

d. 20 more tons of pollution into the air, and Firm B will emit 100 fewer tons of pollution into the air.

a

You might also like to view...

A supply curve is a:

A. graph that visually displays the supply schedule. B. graph depicting various price-quantity combinations of multiple goods. C. graph that shows the quantities of a particular good or service that producers will sell at one price. D. table that displays various price-quantity combinations of a good or service.

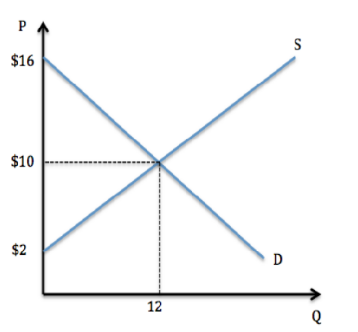

According to the graph shown, consumer surplus is:

A. $36.

B. $72.

C. $120

D. None of these.

When the housing bubble popped, the effect of the negative demand side shock and the negative supply side shock were the same on:

A. output, causing it to definitely decrease. B. prices, causing them to definitely rise. C. output, causing it to definitely increase. D. prices, causing them to definitely fall.

In a perfectly competitive industry, in the long-run equilibrium

A) the typical firm is producing at the output where its long-run average total cost is not minimized. B) the typical firm is earning an accounting profit greater than its implicit costs. C) the typical firm earns zero profit. D) the typical firm is maximizing its revenue.