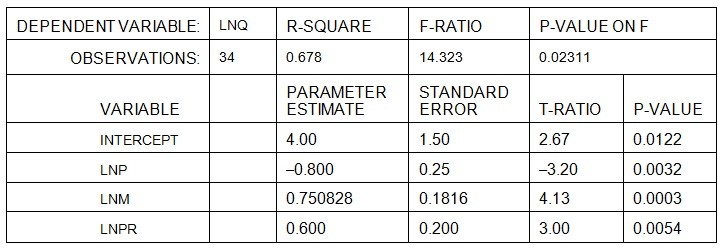

Build-Right Concrete Products produces specialty cement used in construction of highways. Build-Right is a price-setting firm and estimates the demand for its cement by the State Highway Department using a demand function in the nonlinear form:Q = aPbMc where Q = yards of cement demanded monthly, P = the price of Build-Right's cement per yard, M = state tax revenues per capita, and PR = the price of asphalt per yard. The manager at Build-Right transforms the nonlinear relation into a linear relation for estimation. The estimation results are presented below:

where Q = yards of cement demanded monthly, P = the price of Build-Right's cement per yard, M = state tax revenues per capita, and PR = the price of asphalt per yard. The manager at Build-Right transforms the nonlinear relation into a linear relation for estimation. The estimation results are presented below:

height="198" width="577" />Given the above, if tax revenue per capita (M) increases 5%, the estimated quantity of cement demanded will

A. increase more than 1% but less than 5%.

B. increase more than 5% but less than 10%.

C. increase by less than 1%.

D. increase more than 10%.

Answer: A

You might also like to view...

An example of moral hazard is

a. A taxi driver paid per mile taking the shortest route b. a piece-rate garment worker shirking less than a per hour worker c. an hourly salesman working harder than a commission salesman d. an author on contract going to as many book signings as one with a percentage royalty rate

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 required these to be traded in established, regular markets:

a. equities b. derivatives c. credit default swaps d. both b and c.

A trade surplus occurs when:

A. The dollar value of exports exceeds the dollar value of imports. B. The gains from trade are not fully realized. C. A country does not have a comparative advantage in any goods. D. The cost of goods is so high that imports exceed exports.

Exhibit 19-3 Balance sheet of Tucker National Bank Assets Liabilities Required reserves$ 20,000 Checkable deposits$100,000 Excess reserves0 Loans 80,000 Total$100,000 Total$100,000 Assume all banks in the system started with balance sheets as shown in Exhibit 19-3 and the Fed made a $100,000 open market purchase. The result would be a(n):

A. $500,000 expansion of the money supply. B. $100,000 expansion of the money supply. C. $20,000 contraction of the money supply. D. infinite expansion of the money supply.