Assuming that charitable giving is a normal good, the income effect of a decrease in personal tax rates would lead to

A. more giving because households would have more disposable income.

B. less giving because giving to charity would become more expensive relative to other goods.

C. more giving because giving to charity would become less expensive relative to other goods.

D. less giving because households would spend that money on luxury goods.

Answer: A

You might also like to view...

Every society must follow some kinds of criteria to determine who gets what. Examples of such criteria include

A) age. B) gender. C) height. D) willingness to pay. E) all of the above.

IRA stands for Individual Retirement Asset

a. True b. False

What is the present value of $104.25 that you could receive one year from now, given that the rate of interest is 4.25 percent?

A) $108.50 B) $0.00 C) $4.25 D) $100.00

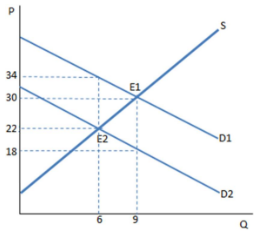

The graph shown demonstrates a tax on buyers. Before the tax was imposed, the buyers purchased ____ units and paid _____ for each one.

A. 6; $22

B. 6; $34

C. 9; $18

D. 9; $30