Comment on the statement: “Discretionary fiscal policy offers an ideal approach to dealing with the nation’s economic problems. It is without problems, criticisms, or complications.”

What will be an ideal response?

Discretionary fiscal policy does offer government policymakers potential tools (changing taxes or government spending) to use for stimulating the economy during a recession or for contracting the economy during a period of high inflation. Fiscal policy, however, is not without its problems, criticisms, or complications. First, there are timing problems in getting it implemented at the right time so it will be effective. Second, there are political problems in getting it accepted because it takes time to get the actions passed through Congress and signed by the President. Third, there are expectations problems because policies may be reversed in the future. Fourth, the taxing and spending decisions of the Federal government may be partially offset by the taxing and spending decisions of state and local governments. Fifth, some economists are concerned that expansionary fiscal policy that requires the Federal government to borrow money will raise interest rates and crowd out investment spending, thus reducing the expansionary effect of the fiscal policy.

You might also like to view...

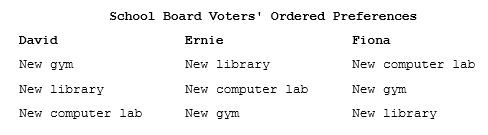

If a first-past-the-post vote was taken by the school board on which project gets funded and the voters' preferences are shown in the table, which project is most likely to win?

A. Computer lab

B. Library

C. Gym

D. It will result in a three-way tie.

When a good is put onto the global market at a price below the cost to produce it, this is known as

A) the infant-industry argument. B) dumping. C) a quota. D) protection of domestic jobs.

Why do monopolistic ally competitive firms spend funds for product differentiation and advertising when this practice only adds to the firm’s costs?

What will be an ideal response?

Monetary policies are designed to affect the

A. quantity of money. B. denominations of currency. C. size of income tax brackets. D. volume of tax revenues.