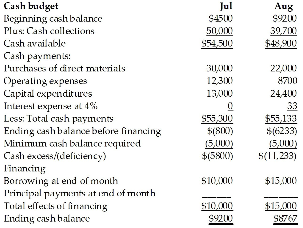

The cash balance on June 30 is projected to be $4500. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 4%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. How much will the company have to borrow at the end of August?

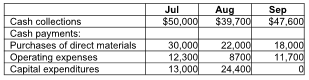

Kennison, Inc. has prepared its third quarter budget and provided the following data:

A) $15,000

B) $5,000

C) $10,000

D) $20,000

A) $15,000

You might also like to view...

What is generally required for fundamental changes in the corporation?

A. Novation B. Board initiative C. Referendum D. Deal protection devices

Velma borrows $110,000 from Watershed Bank to buy a home. If she fails to make payments on the mortgage, the bank has the right to repossess and auction off the property securing the loan. This is

A. a short sale. B. forbearance. C. foreclosure. D. the equitable right of redemption.

The process by which a buyer and seller of a business agree to terms involving inventory, equipment, and price, as a method of becoming a small business owner is known as a/an:

a. acquisition b. buy out c. merger d. succession e. franchise

Jim Meadowmont works for Sony. He doesn't take orders from customers, but he is extremely knowledgeable about the entire Sony product line and about how its specifications compare to the competition's products. He helps a regular Sony salesperson by providing details about how Sony's products work, and he knows the customer applications for which the products are best suited. Jim is a(n)

A. order taker. B. order getter. C. missionary salesperson. D. technical specialist. E. sales manager.