The United States has a dual banking system in the sense that

A) the public may deposit money in either commercial banks or savings-and-loan associations.

B) banks offer both demand deposits and time deposits to savers.

C) banks are chartered by the federal government and by state governments.

D) banks both take in deposits and make loans.

C

You might also like to view...

Refer to Figure 28-3. The shifts shown in the short-run and long-run Phillips curves between period 1 and period 2 could be explained by

A) either an increase in expected inflation from 4.0 to 5.5 percent or an increase in the natural rate of unemployment from 5.5 to 6.8 percent. B) an increase in the expected inflation rate from 4.0 to 5.5 percent. C) an increase in the natural rate of unemployment from 5.5 to 6.8 percent. D) None of the above is correct.

A monetary policy which is likely to bring about a "soft landing" requires that interest rates be ________ while inflation is ________ and unemployment is ________ the natural level

A) raised, rising, above B) raised, falling, below C) lowered, falling, above D) lowered, rising, below

Darcy sells a government security worth $4,600,000 to the Federal Reserve Bank of Kansas City. She deposits these funds in her checking account to the First Commerce Bank. Her checking account had a $150,000 balance before the sale of the security. The reserves of the First Commerce Bank would:

A. increase by $4,750,000. B. increase by $4,600,000. C. decrease by $4,450,000. D. decrease by $4,600,000.

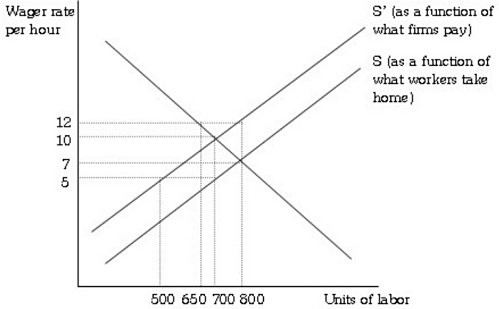

Refer to the information provided in Figure 19.1 below to answer the question(s) that follow.  Figure 19.1 Refer to Figure 19.1. After firms can respond to the payroll tax, the per-hour equilibrium wage paid by firms ________ compared to the original equilibrium wage.

Figure 19.1 Refer to Figure 19.1. After firms can respond to the payroll tax, the per-hour equilibrium wage paid by firms ________ compared to the original equilibrium wage.

A. decreases by $2 B. decreases by $5 C. increases by $3 D. increases by $5