A state decides to pass a new law raising the excise tax on cigarettes. What would be the probable incidence of this new tax?

What will be an ideal response?

An excise tax on cigarettes is partly shifted to consumers because the demand for cigarettes tends to be inelastic. Therefore, producers can pass along the cost of the tax in the form of increased prices to the consumer. To the extent that the quantity demanded falls as a result, the producer will bear part of the cost in the form of reduced revenue and profits.

You might also like to view...

If the economy is inflationary, the Fed would most likely:

a. encourage banks to provide loans by buying government securities. b. encourage banks to provide loans by raising the discount rate. c. encourage banks to provide loans by selling government securities. d. restrict bank lending by selling government securities. e. restrict bank lending by lowering the federal funds rate.

Amy became a tour guide at a national park and was paid $20 per hour to conduct four two-hour tours per day. Each tour generated $400 in revenues for the park. Which of the following shows the marginal resource cost associated with Amy’s labor?

a. $20 hourly rate b. $360 profit per tour c. $1600 revenues per day d. $800 wages per week

If net exports are a negative number, then:

A. we are not buying enough exports. B. we are exporting less than we are importing. C. GDP will underestimated when measured using the expenditure approach. D. we are exporting more than we are importing.

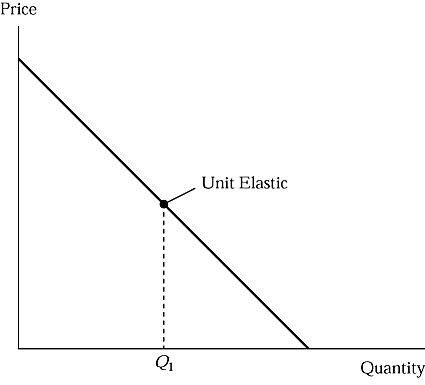

In Figure 4.2, at quantities larger than Q1, demand is:

In Figure 4.2, at quantities larger than Q1, demand is:

A. inferior. B. elastic. C. inelastic. D. unit elastic.