Which of the following is true of the tax and transfer programs of the United States?

a. Tax-transfer programs persistently redistribute income from the rich to the poor.

b. Social Security, the largest transfer program, redirects income toward the elderly, a group with above-average levels of both income and wealth.

c. The bulk of agriculture subsidies go to large farmers with above-average incomes.

d. Taxes generally take a larger share of the income of the poor than is true for those with higher incomes.

e. Both b and c are true.

E

You might also like to view...

What are the major ways that the risks of exchange rate changes can be hedged against?

What will be an ideal response?

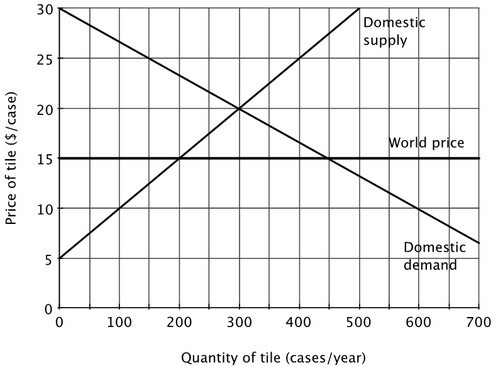

If Utopia opened itself to trade it would

A. export 100 cases of tile per year. B. export 450 cases of tile per year. C. import 250 cases of tile per year. D. import 150 cases of tile per year.

Over a period of time both the price and the quantity sold of a certain product have increased. One possible explanation might be that:

a. Supply decreased over time, while demand remained the same b. Demand increased over time, while supply remained the same c. Supply increased over time, while demand remained the same d. Supply increased over time, while demand declined

In the United States, one problem with central bank independence is:

A. it is almost impossible to obtain because Congress controls the budget of the Federal Reserve. B. central bank independence has not produced favorable results. C. in a representative democracy, monetary policymakers must be held accountable to the public. D. the central bank can control policy, but the U.S. Treasury issues currency.