Assume that the central bank increases the reserve requirement. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the quantity of real loanable funds per time period and real GDP in the context of the Three-Sector-Model?

a. The quantity of real loanable funds per time period and real GDP remain the same.

b. There is not enough information to determine what happens to these two macroeconomic variables.

c. The quantity of real loanable funds per time period falls, and real GDP falls.

d. The quantity of real loanable funds per time period rises, and real GDP falls.

e. The quantity of real loanable funds per time period falls, and real GDP rises.

.C

You might also like to view...

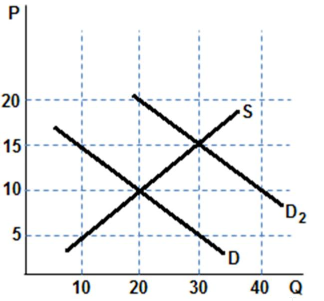

Assume the graph shown represents the market for bottles of wine and was originally in equilibrium with D and S. Something changes and demand shifts to D2. Which of the following is true?

A. Equilibrium price increased by $5.

B. Equilibrium quantity increased by 20.

C. Equilibrium price increased by $15.

D. Equilibrium quantity increased by 30.

AACSB: Analytical Thinking

Residential construction is generally included in which category of GDP?

a. consumption b. investment c. government expenditures d. net exports

Which of the following is true?

a. Monetary policy influences long-term real interest rates more than short-term interest rates. b. Short-term interest rates are primarily determined by real factors and the expected inflation. c. A shift to a more expansionary monetary policy will tend to reduce short-term interest rates. d. A shift to a more expansionary monetary policy will tend to reduce the expected rate of inflation in the future.

Which of the following statements about the World Trade Organization (WTO) is FALSE?

A. The WTO is a development of the General Agreement on Tariffs and Trade (GATT). B. The WTO makes an effort to ensure that trade flows smoothly and predictably. C. The WTO has worked to increase tariff rates in an effort to protect infant industries in developing countries. D. The WTO is the main world organization governing rules of international trade.