Which of the following is false about a liquidity trap situation:

a. Quantitative easing might be a more effective strategy to stimulate the economy than buying short term government securities.

b. The Fed can lower both short term and long term interest rates by using quantitative easing.

c. The Fed cannot easily reduce the fed funds interest rate

d. Quantitative easing may be able to affect long term interest rates even when the Fed is unable to appreciably lower short term interest rates.

b

You might also like to view...

Perfectly competitive firms are earning economic profits at a market price of $10 and an average total cost of $8. If new firms enter and increase the average total cost for all firms, the market price will ________ until ________.

A) fall; it reaches $8 B) increase; it reaches $10 C) increase; economic profit is equal to zero D) fall; economic profit is equal to zero

If resource A and resource B are substitutes of each other and the price of resource A increases, then:

a. the price elasticity of demand for resource B will increase. b. the demand for resource A will increase. c. the demand for resource B will increase. d. the price elasticity of demand for resource B will decrease. e. the demand for resource B will decrease.

Which of the following statements characterize an oligopoly market? a. Oligopoly firms are guaranteed profits due to the lack of competition

b. Firms are aware that their own economic behavior will influence the decisions of rivals. c. There are few barriers to entry. d. Firms choose price and output independently from the decisions made by competitors.

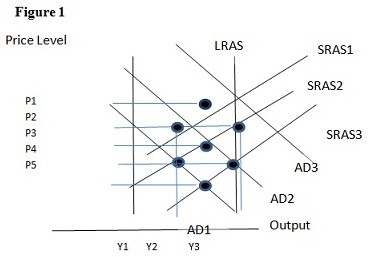

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.