The Federal Reserve helped J.P. Morgan purchased Bear Stearns by agreeing to purchase some unwanted Bear Stearns assets

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

If the government has no debt initially, but then has annual revenues of $10 billion per year for 4 years and annual expenditures of $10.5 billion per year for 4 years, then the government has

A) a budget surplus of $0.5 billion per year and a debt of $2 billion at the end of the 4 years. B) a budget deficit of $0.5 billion per year and a debt of $2 billion at the end of the 4 years. C) a budget surplus of $0.5 billion per year and a surplus of $2 billion at the end of the 4 years. D) a budget deficit of $0.5 billion per year and a budget surplus of $2 billion at the end of the 4 years.

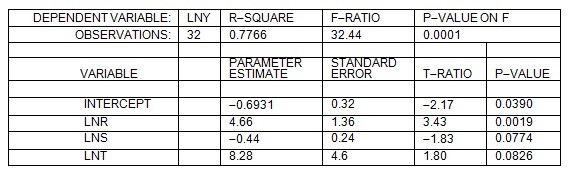

Refer to the following computer output from estimating the parameters of the nonlinear modelY = aRbScTdThe computer output from the regression analysis is:  Based on the info above, if R = 1, S = 2, and T = 3, what value do you expect Y will have?

Based on the info above, if R = 1, S = 2, and T = 3, what value do you expect Y will have?

A. -4,559 B. 1,345 C. 3,289 D. 143 E. 6,578

(Consider This) Governments' main economic concern about low birthrates is that:

A. in a few decades there will not be enough working-age adults to support pension responsibilities to retirees. B. the smaller population makes the economy more vulnerable to foreign takeover. C. a declining population will reduce worker productivity. D. smaller populations are more susceptible to epidemics.

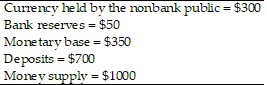

Consider an economy that has the following monetary data. The monetary base and the money supply are expected to grow at a constant rate of 20% per year. Inflation and expected inflation are 20% per year. Suppose that bank reserves and currency pay no interest, all currency is held by the public, and bank deposits pay no interest. What is the cost to the public of the inflation tax?

The monetary base and the money supply are expected to grow at a constant rate of 20% per year. Inflation and expected inflation are 20% per year. Suppose that bank reserves and currency pay no interest, all currency is held by the public, and bank deposits pay no interest. What is the cost to the public of the inflation tax?

A. $190 B. $60 C. $140 D. $200