Marquez purchased some equipment for $58,750 on August 15, 2017. He decided he did not need the equipment so he sold it on June 13, 2018 for $56,500. The equipment was subject to depreciation of $6,964 for 2017 and 2018. What gain or loss will Marquez recognize on the sale of the equipment?

A. $2,250 capital loss.

B. $4,714 ordinary gain.

C. $4,714 capital gain.

D. $2,250 ordinary loss.

Answer: B

You might also like to view...

Which of the following statements can be conditionally privileged in defamation suits?

A. Private statements between spouses B. Statements by members of Congress on the floor of Congress C. Statements by participants in judicial proceedings D. Statements made in the furtherance of legitimate business interests

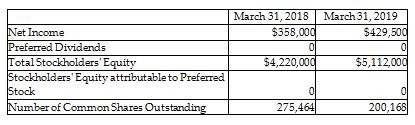

Rather Corporation's annual report is as follows.

If the current market price is $17 on March 31, 2019, compute the price/earnings ratio on March 31, 2019. (Round any intermediate calculations and your final answer to the nearest cent.)

A) 9.39

B) 2.15

C) 1.81

D) 7.91

Which of the following is NOT included in calculating earned value?

a. budgeted costs b. actual costs c. value generated by the project d. potential benefits of the project to the company

When dependent clauses precede independent clauses, they always are followed by a ________

A) period B) semicolon C) comma D) colon