Which of the following is an example of active fiscal policy?

a. Income tax revenues rise in an inflationary period.

b. Income tax revenues fall in a recession.

c. Congress passes a major tax increase in an inflationary period.

d. Unemployment benefits increase in a recession.

c

You might also like to view...

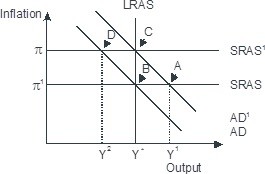

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

What's the firm's current contribution margin?

a. $15 b. $18 c. $3 d. $4

New discoveries of lead, zinc, and copper will reduce prices.

Answer the following statement true (T) or false (F)

If the economy is operating at a point at which short-run aggregate supply is horizontal, then

A. real GDP cannot contract. B. real GDP cannot expand. C. increases in aggregate demand do not increase the price level. D. then increases in aggregate demand do not increase real GDP.