Max Shreck, an accountant, quit his $80,000-a-year job and bought an existing tattoo parlor from its previous owner, Sylvia Sidney. The lease has five years remaining and requires a monthly payment of $4,000. Max's explicit cost amounts to $3,000 per

month more than his revenue. Should Max continue operating his business?

A) Max's explicit cost exceeds his total revenue. He should shut down his tattoo parlor.

B) Max should continue to run the tattoo parlor until his lease runs out.

C) If Max's marginal revenue is greater than or equal to his marginal cost, then he should stay in business.

D) This cannot be determined without information on his revenue.

Answer: B

You might also like to view...

Which of the following is not a potential problem in using corrective taxation to deal with a negative externality?

a. Measuring the cost of the externality. b. Estimating the supply curve of the externality creator. c. Determining who is responsible for the externality. d. Determining how the tax should be applied.

A bond is

A) a legal claim to a part of a corporation's future profits that includes voting rights. B) a legal claim to a part of a corporation's future profits that does not include voting rights. C) a legal claim against a firm, providing a fixed annual coupon payment and a lump-sum payment at maturity. D) a nonlegal promise to provide an annual payment to the holder when the corporation makes profits.

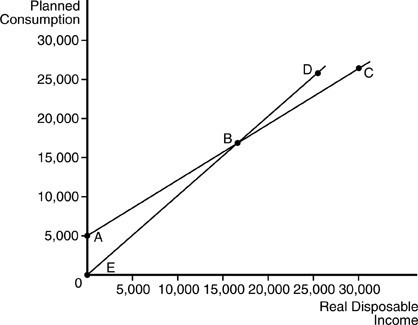

According to the above figure, autonomous consumption equals

According to the above figure, autonomous consumption equals

A. -$5,000. B. $20,000. C. $5,000. D. $0.

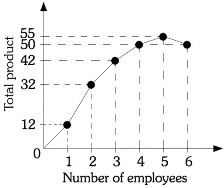

Refer to the information provided in Figure 7.4 below to answer the question(s) that follow.  Figure 7.4Refer to Figure 7.4. The marginal product of the sixth worker is

Figure 7.4Refer to Figure 7.4. The marginal product of the sixth worker is

A. -50. B. -5. C. 5. D. 8.33.