Suppose the economy is initially in long-run and short-run equilibrium. If the Fed decides to pursue a contractionary monetary policy, we will see

A. bond prices fall, interest rates rise, aggregate demand falls as investment spending decreases and consumption spending remains unchanged, and real GDP and the price level decrease in the short run, but only the price level falls in the short run.

B. bond prices fall, interest rates fall, aggregate demand remains unchanged as consumption spending decreases, but investment spending increases. GDP remains constant in both the short run and the long run, but the price level falls in both.

C. bond prices fall, interest rates rise, aggregate demand falls as investment and consumption spending decrease, and real GDP and the price level decreasing in the short-run, but only the price level decreasing in the long run.

D. interest rates rise but no change in bond prices. Aggregate demand falls as consumption spending and investment spending decrease, and the price level and real GDP fall in both the short run and the long run.

Answer: C

You might also like to view...

When economists speak of full employment, they refer to the case in which the sum of frictional and structural unemployment is

A) falling over time. B) equal to zero. C) equal to the actual amount of unemployment. D) greater than the level of deficient demand unemployment.

Automatic stabilizers combine changes in discretionary fiscal policy with changes in government spending and taxes influenced by the business cycle in order to stabilize the economy

a. True b. False Indicate whether the statement is true or false

If Japan is experiencing inflation and the United States is experiencing a recession, international policy coordination would be most likely to occur if it required:

A. expansionary monetary policies in both countries. B. a weakening of the dollar. C. a strengthening of the dollar. D. contractionary fiscal policies in both countries.

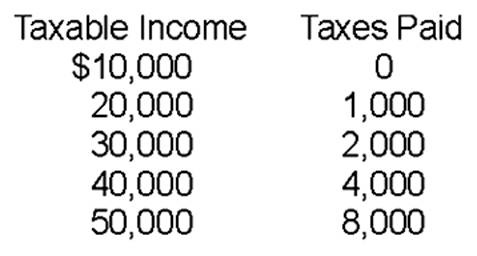

If your taxable income is $50,000, your average tax rate is

A. 8 percent.

B. 12 percent.

C. 16 percent.

D. 20 percent.