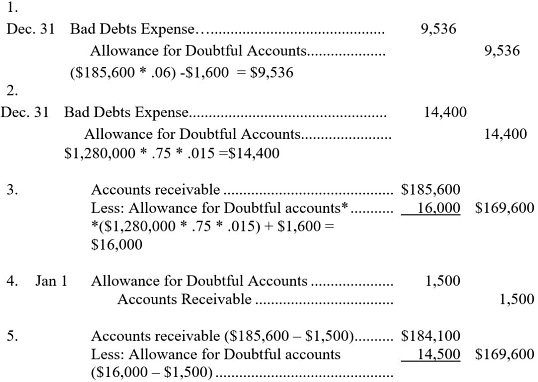

On December 31, of the current year, Spectrum Company's unadjusted trial balance revealed the following: Accounts receivable of $185,600; Sales Revenue of $1,280,000; (75% were on credit), and Allowance for Doubtful Accounts of $1,600 (credit balance).Prepare the adjusting journal entry to record Spectrum's estimate for bad debts assuming:1. 6.0% of the accounts receivable balance is assumed to be uncollectible.2. Bad debts expense is estimated to be 1.5% of credit sales.3. Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear on the balance sheet after adjustment assuming the percentage of sales method is used.4. Prepare the entry to write off a $1,500 account receivable on January 1 of the next year.5. Show how Accounts Receivable and the Allowance for

Doubtful Accounts would appear on the balance sheet immediately after writing off the account in part 4 assuming the percentage of sales method is used.

What will be an ideal response?

You might also like to view...

The standard that must be met for a plaintiff to win a trademark infringement claim is likelihood of confusion.

Answer the following statement true (T) or false (F)

Under the LIFO or retail inventory method the Net Realizable Value is considered the ceiling that prevents inventory from being valued at amount higher than what the company could reasonably sell it

Indicate whether the statement is true or false

______ is the process of paying attention to an entire message, taking into account both the content of the message and the context in which the communication is delivered.

A. Active listening B. Trust C. Communication D. Feedback

Kim has investments in stocks, and wants to calculate her total return. What should she do?

a. Divide the yearly dollar amount of dividend income by the investment's current market value.

b. Compare the dividend against current yields from other investments.

c. Subtract the cost of the stock from what she sold it for.

d. Divide the current dividend payment plus capital gain by the original investment.

e. Subtract current liabilities from current assets.