A tax is imposed on orange juice. Consumers will bear no burden from this tax if the:

a. demand for orange juice is perfectly inelastic

b. supply curve for orange juice is unit elastic.

c. demand for orange juice is unit elastic.

d. supply curve for orange juice is perfectly inelastic.

d

You might also like to view...

The income distribution is a more accurate measure of economic inequality than the wealth distribution because income excludes human capital

Indicate whether the statement is true or false

The unemployment insurance program

a. makes recessions and inflationary episodes more severe b. makes recessions and inflationary episodes less severe c. makes recessions more severe and inflationary episodes less severe d. makes recessions less severe and inflationary episodes more severe e. has no effect on the severity of recessions and inflationary episodes

The decision to save is influenced by all of the following except

A. The level of risk. B. Time preferences. C. Interest rates. D. Occupation.

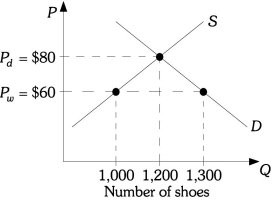

Refer to the information provided in Figure 33.3 below to answer the question(s) that follow. Figure 33.3Refer to Figure 33.3. The domestic price of shoes is $80. After trade the price of a pair of shoes is $60. After trade this country will import

Figure 33.3Refer to Figure 33.3. The domestic price of shoes is $80. After trade the price of a pair of shoes is $60. After trade this country will import

A. 100 pairs of shoes. B. 200 pairs of shoes. C. 300 pairs of shoes. D. 1,300 pairs of shoes.