Explain why bond prices and interest rates are inversely related.

What will be an ideal response?

A bond is an IOU by a corporation that promises to pay the holder of the piece of paper a fixed sum at the specified maturity date and some other fixed amount of money (the coupon or interest payment) every year up to the date of maturity. Once issued, the fixed interest payment does not change. However, the interest payment on newly issued bonds may change to reflect current financial conditions. In order for an investor to be indifferent between an existing bond (issued at some interest rate) and a newly issued bond (issued at current interest rates), the price of the old bond must change to reflect current conditions. If interest rates have fallen since the old bond was issued, the interest payments for the par value of the bond are above current yields. Therefore, investors will seek to buy the bonds, and their price will increase. The price will stop increasing when the yield on older bonds equals the yield on newly issued bonds. Conversely, if interest rates have risen since the old bonds were issued, the opposite will occur, and the price of the old bonds will fall.

You might also like to view...

When markets open up to international trade, we know that total surplus will rise

a. True b. False Indicate whether the statement is true or false

A perfectly competitive firm produces where

a. marginal cost equals price, while a monopolist produces where price exceeds marginal cost. b. marginal cost equals price, while a monopolist produces where marginal cost exceeds price. c. price exceeds marginal cost, while a monopolist produces where marginal cost equals price. d. marginal cost exceeds price, while a monopolist produces where marginal cost equals price.

Determining whether a good is a merit good is:

A. best done using economic theory. B. an objective exercise. C. a subjective exercise. D. best left to economists.

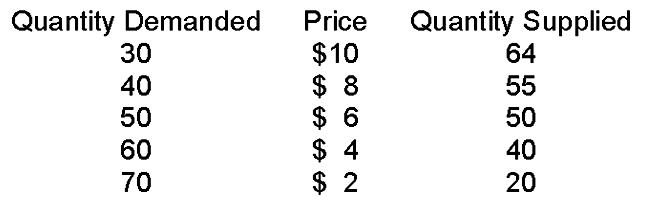

If the government set a price ceiling at $8

A. there would be a temporary surplus, then prices would fall to equilibrium.

B. there would be a permanent surplus, at least until the price floor was lifted.

C. the price would fall back to the equilibrium price.

D. the price floor would not have any effect on this market.