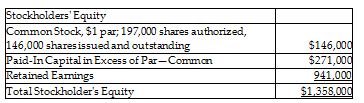

On June 30, 2018, Chris Brothers, Inc. showed the following data on the equity section of their balance sheet:

On July 1, 2018, the company declared and distributed a 8% stock dividend. The market value of the stock at that time was $17 per share. Following this transaction, what is the balance of Paid-In Capital in Excess of Par—Common?

A) $227,640

B) $523,160

C) $271,000

D) $457,880

D) $457,880

Explanation: $271,000 + (11,680 shares × $16 per share) = $457,880

You might also like to view...

______________is a dynamic relationship based on mutual influence and common purpose.

a. Leadership b. Management c. Supervision d. None of the above

Inherent risk List some factors that would lead an auditor to assess inherent risk relating to operations at a higher level

Which of the following accounts would be found on the credit side of the adjusted trial balance?

A) Accumulated Depreciation-Equipment B) Prepaid Insurance C) Dividends D) Depreciation Expense

How are trends in layout design affecting retail and restaurant environments? Give at least one example from each environment.

What will be an ideal response?