A company reported $960,000 in net income for the current year. Total weighted-average common shares outstanding are 150,000 shares, and the year-end market price is $67.20 per common share. Calculate the company's price earnings ratio.

What will be an ideal response?

Price-Earnings Ratio = Market Price per Share/ (Net Income/Weighted-Average

Common Shares Outstanding)

Price-Earnings Ratio = $67.20/ ($960,000/150,000 shares) = 10.5

You might also like to view...

A decrease in accounts receivable should be presented in a statement of cash flows (indirect method) as

a. an inflow and outflow of cash. b. an outflow of cash. c. a deduction from net income. d. an addition to net income.

After making a presentation, you reflect by focusing on what went well and what didn’t go as well, and if the experience was useful or helpful. What type of reflection does this describe?

a. emotional reflection b. analytical reflection c. evaluative reflection d. critical reflection

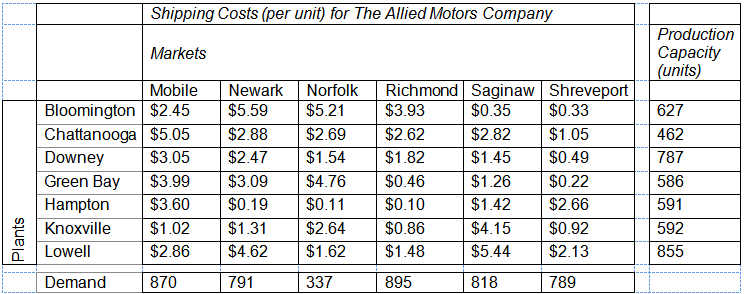

Refer to the Shipping Costs for The Allied Motors Company. Solve the transportation problem using Excel Solver. (Remember that in balanced transportation problems all constraints—except the non-negativity constraints of the decision variables—should be set as an equal-to (=) sign in the Excel Solver dialogue.) At the optimum solution, the total cost of shipping from all plants to Saginaw is ______.

a. $893

b. $496

c. $672

d. $576

Warehouses that producers set up at separate locations away from their factories are known as

A. progressive wholesalers. B. corporate chains. C. hypermarkets. D. manufacturers' sales branches. E. retail production centers.