Which of the following statements is false regarding the abnormal earnings approach to valuation?

A. The method uses the cost of capital as a fundamental economic benchmark.

B. This approach is based on the notion that the value of a company is driven primarily by the level of earnings.

C. This approach produces results that are generally equivalent to the free cash flow model.

D. The method uses earnings and equity book value numbers as direct inputs in the valuation process.

Answer: B

You might also like to view...

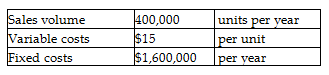

Using the cost-plus pricing approach, what should be the sales price per unit? (Round your answer to the nearest cent.)

Titan Metalworks produces a special kind of metal ingots that are unique, which allows Titan to follow a cost-plus pricing strategy. Titan has $10,000,000 of assets and shareholders expect approximately a 8% return on assets. Assume all products produced are sold. Additional data are as follows:

A) $15.00

B) $19.00

C) $21.00

D) $2.00

Austin's Pub Supply uses the periodic inventory system and the gross method of accounting for sales. The company had the following sales transactions during August: August 2Sold merchandise to Jo's Pub and Grub on credit for $3,750, terms 2/15, n/60. The items sold had a cost of $1,200. August 4 Jo's Pub and Grub returned merchandise that had a selling price of $300. The cost of the merchandise returned was $110.August 13Jo's Pub and Grub paid for the merchandise sold on August 2, taking any appropriate discount earned.Prepare the journal entries that Austin's Pub Supply must make to record these transactions.

What will be an ideal response?

If a company's bonds are callable:

A) the bondholder has the right to sell an option on the bond. B) the issuing company is likely to retire the bonds before maturity if the bonds are paying 8% interest while the market rate of interest is 4%. C) the bonds are never allowed to remain outstanding until the maturity date. D) the investor never knows what the redemption price will be until the bonds are actually called.

A company produces 400 microwave ovens per month, each of which includes one electrical circuit

The company currently manufactures the circuit in-house but is considering outsourcing the circuits at a contract cost of $48 each. Currently, the cost of producing circuits in-house includes variable costs of $26 per circuit and fixed costs of $7,000 per month. Assume the company could not reduce any fixed costs by outsourcing and that there is no alternative use for the facilities presently being used to make circuits. If the company outsources, operating income will ________. A) increase by $19,200 B) decrease by $10,400 C) decrease by $8,800 D) stay the same