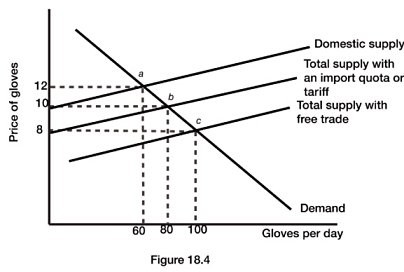

Refer to Figure 18.4. With a tariff, how much does the government collect for each glove imported into Duckland?

Refer to Figure 18.4. With a tariff, how much does the government collect for each glove imported into Duckland?

A. $0

B. between $2 and $3

C. between $8 and $10

D. more than $10

Answer: B

You might also like to view...

Which of the following reduced the demand stimulus effects of the Fed's low interest rate policy pursued during, and after, the financial crisis of 2008-2009?

a. Declining stock prices during 2010-2012. b. An increase in the velocity of money. c. A reduction in earnings derived from money market accounts, saving deposits, and similar saving instruments. d. A sharp increase in the rate of inflation during 2009-2012.

Based on the rising housing prices of 2000-2005, many buyers opted for interest-only loans and variable rate mortgages with little or no down payment because

a. they expected short-term interest rates to fall substantially in the future and this would reduce their monthly mortgage payment in the years ahead. b. variable rate mortgages are a good way to reduce the risk accompanying your investment when you plan to stay in the house for a long time. c. they thought housing prices would continue to rise and therefore they would be able to sell the house for a profit within a couple of years. d. they could easily recoup their investment, even if there was a downturn in housing prices in the future.

If a tax is levied on the sellers of a product, then the supply curve will

A. shift up. B. become flatter. C. shift down. D. not shift.

Which statement if false?

A. If the U.S. can produce rice more efficiently than Japan can, the U.S. enjoys an absolute advantage. B. Economists dislike both tariffs and import quotas. C. Under the law of comparative advantage, total output is greatest when each product is made by the country that produces it most efficiently. D. No nation will engage in trade with another nation unless it will gain by that trade.