Suppose a presidential candidate campaigns on the need to improve U.S. infrastructure, a term for capital goods like bridges, highways, and technology (much of it publicly owned). Which would lead to faster growth: government expenditure on capital goods or expenditure on consumption goods such as sports stadiums? Illustrate your answer, drawing appropriate production possibilities frontiers accompanied by an explanation.

What will be an ideal response?

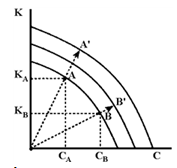

Figure 3-7

?

You might also like to view...

With the policy rate set at zero, the rise in expected inflation will lead to a ________ in the real interest rate, which will cause investment spending and aggregate output to ________

A) fall; rise B) fall; fall C) rise; rise D) rise; fall

Under __________ a borrower gets advance approval from the SEC to issue securities up to a certain amount at an unspecified time in the future

A) advance registration B) pre-registration C) guaranteed registration D) shelf registration

A consumer values a house at $525,000 and a producer values the same house at $485,000 . If the transaction is completed at $510,000 . what level of tax rate will result in unconsummated transaction?

a. 1% b. 5% c. 3% d. 2%

Within the framework of the Keynesian model, if aggregate expenditures exceed aggregate output, then:

a. the inventories of firms would decline, and the firms would expand output in order to restore their inventories to desired levels. b. the inventories of firms would increase, and the firms would reduce output until inventories were cut back to the desired level. c. the current level of income would persist in the future. d. firms would reduce their investment, and the economy would fall into a recession.