Assume there are two companies. Both issue stock, but one is high quality and the other low quality. If potential investors cannot distinguish the quality of the company:

A. this is an example of moral hazard and the shares of both companies will cease to trade.

B. the shares of both companies will trade on the market.

C. the shares of the high quality firm will disappear from the market.

D. the shares of the low quality firm will disappear from the market.

Answer: C

You might also like to view...

Suppose when the price of movie tickets is $7.50, the quantity demanded is 550, and when the price is $8.50, the quantity demanded is 450. Using the mid-point method, the price elasticity of demand is:

A. 0.625 B. 0.625 C. 1.6 D. 1.6

The economic way of thinking is

a. a set of historical generalizations that indicates what goods should be produced. b. a body of statistical data that indicates how an economy should be organized. c. a set of basic concepts that helps one understand human choices. d. a set of complex, highly abstract theories that provides persons skilled in statistics with the information necessary to tell others what choices they should make.

Other things the same, an increase in the foreign price level

a. reduces the real exchange rate. This reduction could be offset by a decrease in the domestic price level. b. reduces the real exchange rate. This reduction could be offset by an increase in the domestic price level. c. increases the real exchange rate. This increase could be offset by a decrease in the domestic price level. d. increases the real exchange rate. This increase could be offset by an increase in the domestic price level.

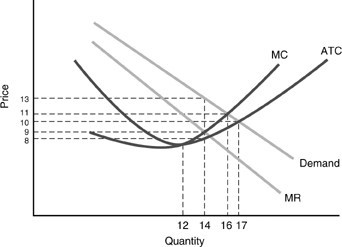

In the above figure, what is total revenue at the profit-maximizing point?

In the above figure, what is total revenue at the profit-maximizing point?

A. $170 B. $176 C. $126 D. $182