Which of the following firms faces monopolistic competition?

a. A poultry farm selling eggs to different bakeries

b. A fashion store selling clothes at an up-scale boutique

c. A fruit-bowl shop at a local market

d. A movie hall selling tickets in advance for an upcoming blockbuster

b

You might also like to view...

Suppose the current price of a pound of steak is $6 per pound and the equilibrium price is $9 per pound. What takes place?

A) There is a shortage, so the price rises and quantity demanded increases. B) There is a shortage, so the price falls and quantity demanded increases. C) There is a surplus, so the price falls and quantity demanded increases. D) There is a shortage, so the price falls and quantity demanded decreases. E) There is a shortage, so the price rises and quantity demanded decreases.

The federal funds interest rate

a. can be raised or lowered by the Federal Reserve to regulate the volume of loans to banks. b. is administered by the Open Market Committee. c. increases when the fed conducts open market purchases. d. is set by Congress. e. none of the above.

Which of the following is consistent with international trade theory?

A) The United States needs trade restrictions to stay competitive. B) The United States has been falling behind Europe and Japan because its economy is too open. C) The standard of living within a country is a function of the economic strength of the economy and not of its relative position. D) A country should strive for comparative advantage in manufacturing.

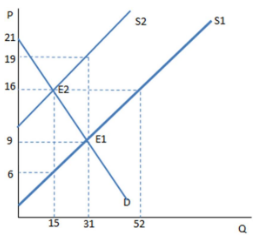

The graph shown demonstrates a tax on sellers. Which of the following can be said about the effect of this tax?

A. The price paid by buyers is greater than that received by sellers, and the difference is the tax wedge.

B. The price paid by buyers is less than that received by sellers, and the difference is the total tax revenue.

C. The price paid by buyers is greater than that received by sellers, and the difference is the total tax revenue.

D. The price paid by buyers and received by sellers is higher than it was before the tax was imposed.