How do households make saving decisions?

What will be an ideal response?

A household's saving depends on five factors: the real interest rate, the household's disposable income, the household's expected future income, wealth, and default risk. A household increases its saving if the real interest rate increases, its disposable income increases, its expected future income decreases, its wealth decreases, or if default risk decreases.

You might also like to view...

Changing the price of good Y will

A. only affect the demand for that good. B. have effects across some markets. C. keep prices down in all markets. D. have no effect.

Pollution taxes are paid out of the EPA Superfund in order to reduce automobile emissions

a. True b. False

A serious burden of a budget deficit and an increase in the national debt comes on the supply side because large budget deficits

a. discourage consumption and therefore lead to production cutbacks. b. lead to lower interest rates and therefore to excessive optimism by consumers and businesspeople. c. discourage investment and therefore may reduce the growth of the nation's capital stock. d. discourage foreign investment and therefore limit employment opportunities.

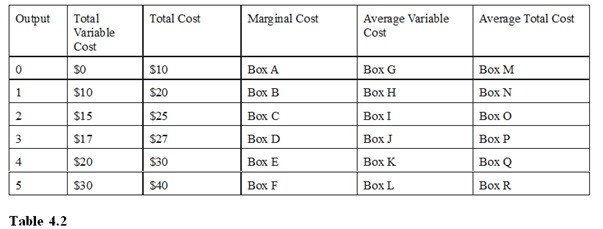

Referring to Table 4.2, Box D should be filled with

A. $2. B. $17. C. $27. D. $0.