If an investor had a $200,000 long-term capital gain on a $50,000 investment from 1984 to 2010, her real annualized rate of return was most likely

A. equal to the real rate of inflation.

B. between 11 and 20 percent.

C. between 0 and 10 percent.

D. negative.

Answer: B

You might also like to view...

What is "tax incidence"? What determines tax incidence in a competitive market?

What will be an ideal response?

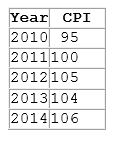

According to the table shown, what can be said about the cost of living in 2010?

A. It was lower than in the base year.

B. People experienced a decrease in the cost of living because the CPI is less than 100.

C. People experienced an increase in the cost of living because the CPI isn't over 100.

D. There must have been a recession because the CPI is less than 100.

At the equilibrium price of a good, the good will be sold by those sellers

a. whose cost is more than price. b. whose cost is less than price. c. that can produce the good. d. enter the market first.

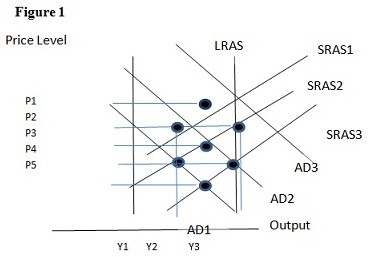

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.