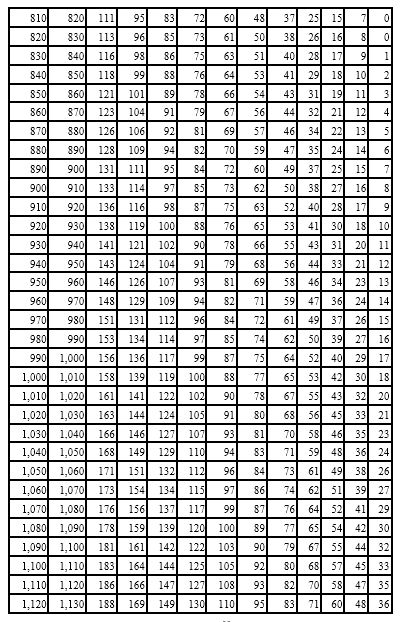

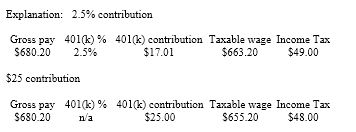

Andie earned $680.20 during the most recent weekly pay period. She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan. If she chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table)?

A) $61.00

B) $59.00

C) $48.00

D) $49.00

C) $48.00

You might also like to view...

Why would an expatriate manager be better in one situation but a host-country manager better in another?

What will be an ideal response?

Outsourcing is often done primarily to accomplish all of the following except?

a. Reduce costs b. Enhance competitiveness c. Increase lead times d. Provide access to competencies that are not core to a firm

Jim walked into a clothing store that was advertising a sale. He saw a section of the store selling merchandise for $15, another section selling for $25, and another section for $40. In this case the retailer is using:

a. cost-oriented pricing b. price lining c. prestige pricing d. odd-even pricing e. customary pricing

PERT is a probabilistic technique, whereas CPM is a deterministic technique

Indicate whether the statement is true or false