The double taxation problem occurs because households pay taxes on dividends and capital gains from stock and corporations pay taxes on corporate profits

Indicate whether the statement is true or false

TRUE

You might also like to view...

To construct an ordinary demand curve for good X,

a. change the price of good X in the consumer choice diagram and observe the change in the quantity of good X among the optimum market baskets. b. change the prices of both goods in the consumer choice diagram and observe the change in the quantity of good X among the optimum market baskets. c. change the price of good Y in the consumer choice diagram and observe the change in the quantity of good X among the optimum market baskets. d. change the consumer's income in the consumer choice diagram and observe the change in the quantity of good X.

By 1900, what did the National Banking System under the Bank Act of 1863 (and subsequent amendments) help national banks attain?

(a) A majority of banking establishments (b) A majority of banking assets (c) A monopoly issue of paper money (d) All of the above

Government purchases are said to have a

a. multiplier effect on aggregate supply. b. multiplier effect on aggregate demand. c. liquidity-enhancing effect on aggregate supply. d. liquidity-enhancing effect on aggregate demand.

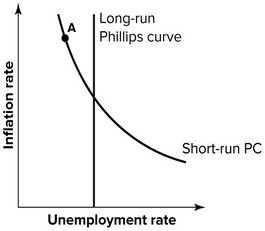

If the economy is at Point A in the Phillips curve graph shown, in the long run, the unemployment would be expected to:

A. decrease. B. immediately fall to zero. C. increase. D. remain constant.