Wages are considered "active income."

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

Klapper Company claimed a tax deduction which was uncertain when it was deducted in 2018 but is relatively certain of receiving the deduction over a five-year period. Which of the following is not correct in accounting for the uncertain tax item?

A. The contingency reserve is reduced each year with the offset to the deferred tax account. B. As the company will ultimately get 100% of the deduction, no contingency reserve is required. C. A contingency reserve will be set up at the same amount as the deferred tax asset if the firm is certain it may claim 100% of the deduction over time. D. Income tax expense in the first year is the current portion of income tax expense minus the increase in the deferred tax asset.

Podcasts are considered to be media rich communication tools

Indicate whether the statement is true or false.

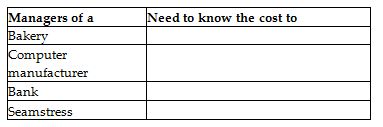

For each of the following types of business, indicate why the manager needs to know the unit cost information.

Roth is a computer-consulting firm. The number of new clients that they have obtained each month has ranged from 0 to 6. The number of new clients has the probability distribution that is shown below. Number of New Clients Probability 0 0.05 1 0.10 2 0.15 3 0.30 4 0.25 5 0.10 6 0.05 ? The variance is

A. 1.45. B. 2.09. C. 3.1. D. 9.61.