Explain how a specific tax equal to the marginal harm of pollution can increase or decrease total welfare in a monopoly market

What will be an ideal response?

If the monopoly is producing more output and pollution than the social optimum, then a specific tax equal to the marginal harm of pollution will increase total welfare. However, a monopoly may produce less output and thus pollution than is socially optimal. If this is the case, then a tax will decrease output more and lower welfare.

You might also like to view...

It is true of externalities that they

A. are always detrimental. B. are always beneficial. C. arise when all costs, social and private, are included in production cost. D. cause the price system to misallocate resources.

What are the three major types of quotas?

What will be an ideal response?

The budget line is downward sloping, reflecting the fact that you must give up some of one good to get more of the other

a. True b. False Indicate whether the statement is true or false

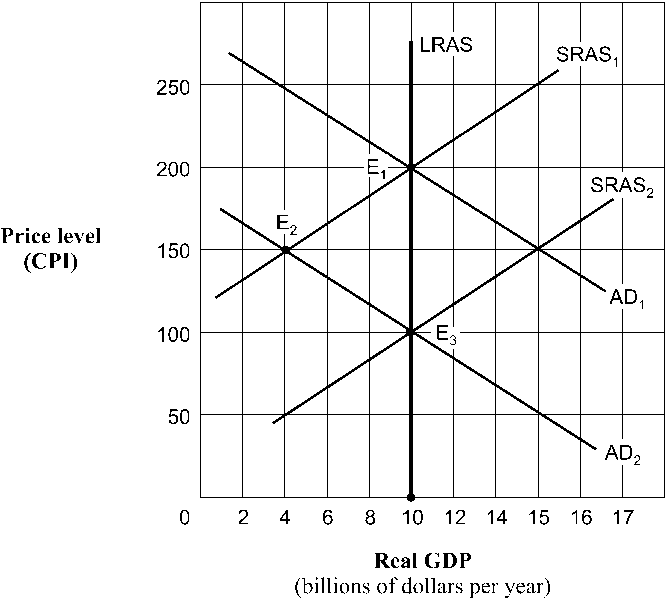

Figure 10-18

As shown in , and assuming the aggregate demand curve shifts from AD1 to AD2, the full-employment level of real GDP is

a.

$10 billion.

b.

$4 billion.

c.

$100 billion.

d.

unable to be determined.