How is state and local government funded and how does such funding differ from federal government funding?

State and local governments rely heavily on indirect taxes, such as sales taxes, excise taxes, and property taxes. At the state level, sales taxes are the largest source of revenue; and in some states, the income tax is becoming more important. (In an attempt to reduce regressivity, some states exempt groceries and prescription drugs from sales taxes.) Excise taxes at the state level include taxes on tobacco, alcohol, gasoline and some luxury items. Cities rely heavily on property taxes for revenue. Some also impose income and sales taxes to obtain revenue. Both also rely to some extent on grants from the federal government.

The federal government relies more on direct taxes than do state and local governments. The largest source of revenue is the personal income tax, a progressive tax. The second largest source of revenue is the payroll tax, a somewhat regressive tax. Other sources of revenue include the corporate income tax and various excise taxes, which are indirect taxes.

You might also like to view...

The figure above shows the costs associated with producing paper. When paper is produced, there is some pollution runoff into a lake. Without regulation, ________ tons of paper will be produced and the price will be ________ per ton

A) 3; $150 B) 4; $100 C) 4; $200 D) None of the above answers is correct.

Which of the following is NOT considered to be a benefit of unionism?

A) increased featherbedding B) greater workplace safety C) higher workforce stability D) provision of arbitration and grievance procedures

Economics examines the options open to households, business firms, governments, and entire societies by the limited resources at their command

a. True b. False Indicate whether the statement is true or false

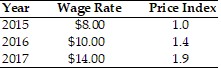

Refer to the information provided in Table 30.2 below to answer the question(s) that follow.

Table 30.2 Refer to Table 30.2. What is the real wage rate in 2017 using 2015 as the base year?

Refer to Table 30.2. What is the real wage rate in 2017 using 2015 as the base year?

A. $4.21 B. $6.65 C. $7.37 D. $15.20