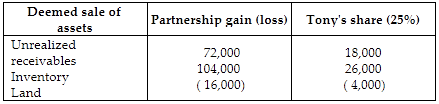

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the allocation of Tony's gain to the assets received?

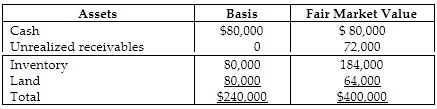

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:

You might also like to view...

When bonds are issued at a discount, both bonds payable on the balance sheet and interest expense on the income statement are affected

a. True b. False Indicate whether the statement is true or false

Liabilities are reported on which of the following financial statement(s)?

A. Statement of changes in stockholders' equity B. Income statement C. Statement of cash flows D. Balance sheet

What is the payback period for the Boeing 787 Dreamliner project? The Boeing 787-8 can carry 230 passengers up to 8,200 nautical miles at a cruising speed of mach 0.85

The Dreamliner is more comfortable for passengers because of higher cabin humidity. Boeing completed construction of its final assembly plant in Everett Washington in December 2007 at a total cost of $7B. Boeing has secured sales of 865 aircraft over the period 2008-2012 for total proceeds of $138.4B ($160M per aircraft). The cost of building each plane is $140M. Assume that sales (and costs) occur in December of each year. Assume that sales are spread evenly across the five years from 2008-2012. The project cash flows are shown in the table, below. What is the payback period for the project? Ignore taxes. Year Capital Investment Annual Sales Annual Revenues Annual Costs Cash Flows 2007 -$7,000M -$7,000 2008 173 $27,680 $24,220 $3,460 2009 173 $27,680 $24,220 $3,460 2010 173 $27,680 $24,220 $3,460 2011 173 $27,680 $24,220 $3,460 2012 173 $27,680 $24,220 $3,460 A) 2 months B) 2.02 years C) 3.4 years D) 7 years E) 24 years

Law consists of: A) principles that govern conduct

B) mere guidelines. C) arbitrary rules. D) traditions.