Proponents of the estate and gift tax argue that the tax is necessary because:

A. it generates a large portion of total federal revenue.

B. it prevents "unfair" accumulation of wealth across generations.

C. it is only applied to items that have not previously been taxed.

D. it is the primary source of funding for Medicare and Medicaid.

Answer: B

You might also like to view...

On a given day the quantity of money is ________ and the supply of money curve is ________

A) fixed; horizontal B) fixed; vertical C) variable; horizontal D) variable; vertical

The price of pizza falls by 25 percent. If the elasticity of demand for pizza is equal to –1.5, what will happen to the quantity of pizza demanded?

What will be an ideal response?

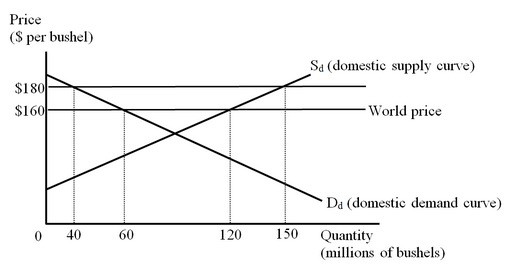

The figure below represents the domestic market for wheat in a small country. Imports of wheat are prohibited. With an export subsidy of $20 per bushel, the cost to the government of paying the export subsidy is

With an export subsidy of $20 per bushel, the cost to the government of paying the export subsidy is

A. $600 million. B. $2.2 billion. C. $3 billion. D. $1.2 billion.

In the former Soviet Union most goods and services were produced by ____________; in the United States most goods and services are produced by _____________.

A. the government; private enterprise B. the government; the government C. private enterprise; the government D. private enterprise; private enterprise