If the price of a company's stock is expected to fall in the future, then people holding such shares will have an incentive to get rid of them

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

A monopolist should shut down in the short run if

a. price is less than average variable cost b. price is greater than average total cost c. marginal revenue equals marginal cost d. marginal revenue is less than marginal cost e. price exceeds average fixed cost

Assume that foreign capital flows into a nation rise due to expected increases in stock market appreciation. If the nation has highly mobile international capital markets and a fixed exchange rate system, what happens to the quantity of real loanable funds per time period and the nominal value of the domestic currency in the context of the Three-Sector-Model? a. Real GDP rises and nominal value

of the domestic currency falls. b. Real GDP falls and nominal value of the domestic currency remains the same. c. Real GDP rises and nominal value of the domestic currency remains the same. d. Real GDP rises and nominal value of the domestic currency rises. e. There is not enough information to determine what happens to these two macroeconomic variables.

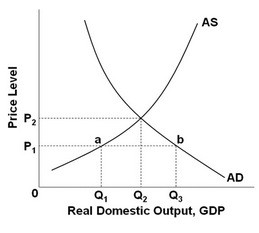

Refer to the above graph. This economy is at equilibrium:

Refer to the above graph. This economy is at equilibrium:

A. at point b. B. at price level P1 and output Q1. C. at point a. D. at price level P2 and output Q2.

The main advantage of trade between two countries is that

A. trade will lead to a more equitable distribution of income in both countries. B. trade makes both countries more self-sufficient. C. employment in both countries will increase. D. both countries have consumption choices beyond their current resource and production constraints.