Assuming perfect asset substitutability, can sterilized intervention by the central bank be effective? Please discuss

What will be an ideal response?

No, a sterilized foreign exchange intervention by the central bank leaves the domestic money supply unchanged. Under floating exchange rates, a change in the interest rate is needed to affect the exchange rate, but the interest rate won't change if the money supply does not. Under a fixed exchange rate, an expansive policy needs to be offset by an increase in the domestic money supply. To avoid inflation, the central bank sterilizes this increase in the money supply by selling domestic assets. However, with a fixed exchange rate, this means buying foreign assets. If foreign assets are perfect substitutes for domestic assets, this sterilization is not effective.

You might also like to view...

Liquidity refers to the ability of an asset to hold its value in periods of inflation

a. True b. False Indicate whether the statement is true or false

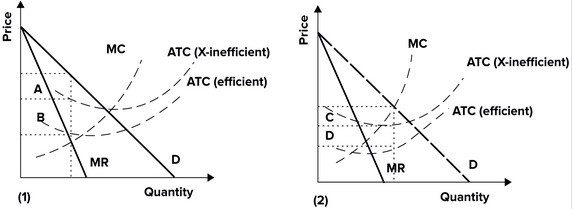

Refer to the graphs shown. The maximum profits that an efficient monopolist that produces a profit-maximizing quantity could earn is best shown by the area:

The maximum profits that an efficient monopolist that produces a profit-maximizing quantity could earn is best shown by the area:

A. A in graph (1). B. A + B in graph (1). C. C in graph (2). D. C + D in graph (2).

The ________ hypothesis suggests that errors in forecasting future inflation rates are due to random, unpredictable events.

A. chaos-theory B. stagflation C. rational-expectations D. Friedman

When demand is price-inelastic, ceteris paribus, an increase in

A. Price leads to greater total revenue. B. Total revenue indicates a reduction in price. C. Price leads to lower total revenue. D. Total revenue means quantity rises.