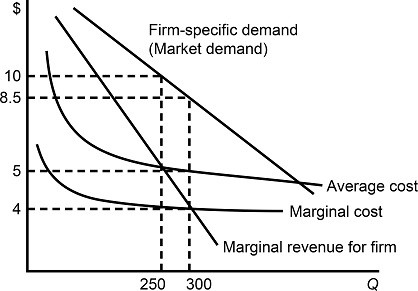

Figure 8.2 shows demand and costs for a monopolistically competitive firm. In the long run we expect:

Figure 8.2 shows demand and costs for a monopolistically competitive firm. In the long run we expect:

A. more firms to enter the market.

B. the firm's demand curve to shift to the right.

C. the price of the good to increase.

D. the average cost of production to decrease.

Answer: A

You might also like to view...

Suppose you were a forecaster of the real wage rate, employment, output, the real interest rate, consumption, investment, and the price level. A shock hits the economy, which you think is a temporary adverse supply shock

(a) What are your forecasts for each of the variables listed above (rise, fall, and no change)? (b) What if the shock was really due to people's reduced expectations about their future income. Which variables did you forecast correctly, and which did you forecast incorrectly?

A rise in the real exchange rate is called

A) a real depreciation. B) a real appreciation. C) a real bargain. D) a real devaluation.

In the long run, the output of a monopolistically competitive firm

a. exceeds that of an otherwise similar perfectly competitive firm b. is less than that of an otherwise similar perfectly competitive firm c. is at the point at which LRAC is minimized d. equals that of an otherwise similar perfectly competitive firm e. is less than that of an otherwise similar monopolist

An import quota on a product protects domestic industries by

a. reducing the foreign supply to the domestic market and, thereby, raising the domestic price. b. increasing the foreign supply to the domestic market and, thereby, lowering the domestic price. c. increasing the domestic demand for the product and, thereby, increasing its price. d. providing the incentive for domestic producers to improve the efficiency of their operation and, thereby, reduce their per-unit costs of production.