[The following information applies to the questions displayed below.]On January 1, Year 1, Vanguard Company purchased a copyright for $12,000. Vanguard estimated the remaining useful life of the copyright to be 6 years. Which of the following correctly shows the effect of the first year's amortization of Vanguard's copyright? Assets=Liab.+EquityRev.?Exp.=Net Inc.Stmt of Cash FlowsA.+ NA +NA + ?+OA B.? NA ?NA + ?NAC.NA + ?? NA ?NAD.? NA ?NA + ??OA

A. Option A

B. Option B

C. Option C

D. Option D

Answer: B

You might also like to view...

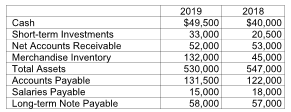

Compute the acid-test ratio for 2018. (Round your answer to two decimal places)

The financial statements for Silver Service Company include the following items:

A) 0.92

B) 0.81

C) 0.93

D) 0.66

Diamond Plywood, Inc., manufactures four types of plywood panels. Each product must go through the following operations: patching, grading, gluing, and baking. The time in hours required for each operation for each panel, the total capacity available for each of these operations in a given month, as well as the minimum production requirements and the profit contributions per panel are given in the following table. Based on this information, at the optimal production point what is the profit from soft plywood panels?

A. $7,400.00

B. $8,200.00

C. $6,640.00

D. $7,950.00

Fact Pattern 3-1BOrin and Pia engage in a business transaction from which a dispute arises. Orin initiates a lawsuit against Pia by filing a complaint.Refer to Fact Pattern 3-1B. If Pia files a motion to dismiss, and the court denies it

A. Orin will be given more time to file an amended complaint. B. Orin will have a judgment entered in his favor. C. Pia will be given more time to file another response. D. Pia will have a judgment entered in her favor.

Dagostino Corporation uses a job-order costing system. (1)Direct materials requisitioned for use in production,$154,000

(2)Indirect materials requisitioned for use in production,$45,000 (3)Direct labor wages incurred,$94,000 (4)Indirect labor wages incurred,$119,000 (5)Depreciation recorded on factory equipment,$44,000 (6)Additional manufacturing overhead costs incurred,$83,000 (7)Manufacturing overhead costs applied to jobs,$236,000 (8)Cost of jobs completed and transferred from Work in Process to Finished Goods,$458,000 Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts below.Work In ProcessBal.$48,000 Manufacturing Overhead The total amount of manufacturing overhead actually incurred was: A. $247,000 B. $246,000 C. $291,000 D. $236,000