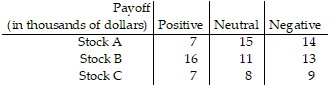

Solve the problem.A person has hired an investment broker to buy stock. The broker has three different stock funds that are of interest, but each is sensitive to a certain economic indicator that is impossible to predict. The indicator will be positive, neutral, or negative. The table below shows the payoffs in thousands of dollars. Find the strategy that the broker should recommend to maximize the expected value of the investment.

A. Invest in Stock A with probability 4/13, invest in Stock B with probability 9/13, and invest in Stock C with probability 0.

B. Invest in Stock A with probability 0, invest in Stock B with probability 1, and invest in Stock C with probability 0.

C. Invest in Stock A with probability 1, invest in Stock B with probability 0, and invest in Stock C with probability 0.

D. Invest in Stock A with probability 5/13, invest in Stock B with probability 8/13, and invest in Stock C with probability 0.

Answer: D

You might also like to view...

Solve the equation after making an appropriate substitution.x2/3 - 6x1/3 + 5 = 0

A. {1, 125} B. {-125, -1} C. {1, 5} D. {-5, -1}

Find the vertex of the parabola.f(x) = -2x2 + 13x + 6

A.

B.

C.

D.

Write the expression in the standard form a + bi.(9 - 6i) + (8 + 8i)

A. 1 + 14i B. 17 - 2i C. -17 - 2i D. 17 + 2i

Find the domain of the function.f(x) = log(x - 8)

A. (-8, ?) B. (1, ?) C. (0, ?) D. (8, ?)