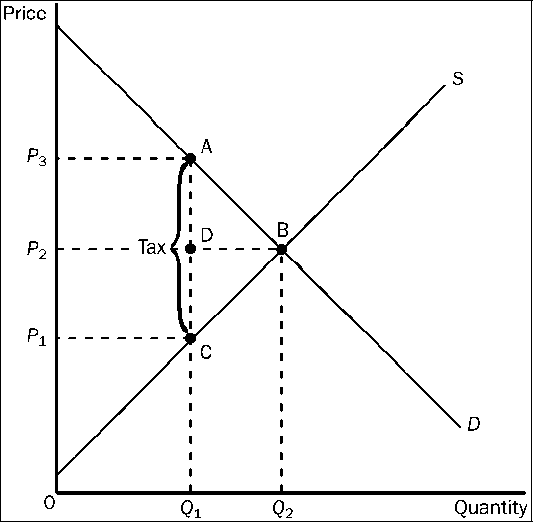

Figure 4-24

Refer to . The price that sellers receive after the tax is imposed is

a.

P1.

b.

P2.

c.

P3.

d.

impossible to determine from the figure.

a

You might also like to view...

At a competitive equilibrium, if there are no taxes, subsidies, price regulations, quantity regulations, or externalities,

A) the marginal benefit is greater than the marginal cost. B) resource use is efficient. C) the marginal benefit is less than the marginal cost. D) both the marginal benefit and the marginal cost of the last unit produced equal zero. E) the marginal benefit is greater than the marginal cost by as much as possible.

Examples of deflators are the ________ and ________ deflator

A) real; nominal B) private disposable income; gross national product C) personal consumption expenditure; gross domestic product D) gross domestic product; rental income E) private disposable income; personal consumption expenditure

An advantage of a unit tax is that the relative price changes have no effect on the tax per unit

a. True b. False

An optimum currency area functions best when labor is immobile from country to country

a. True b. False