Which of the following statements is true?

A. The total demand for money is directly related to the interest rate.

B. A lower interest rate raises the opportunity cost of holding money.

C. The supply of money is directly related to the interest rate.

D. Bond prices and the interest rate are inversely related.

Answer: D

You might also like to view...

The figure above shows the loanable funds market. If the real interest rate is 2 percent, then

A) there is a surplus in the loanable funds market. B) there will be a leftward shift in the demand for loanable funds curve. C) there will be government intervention in the market to make sure there is no credit crisis. D) there is a shortage in the loanable funds market E) the demand for loanable funds curve will shift rightward.

The tax cuts of 2008 and 2009 reduced the disposable income of U.S. consumers

a. True b. False Indicate whether the statement is true or false

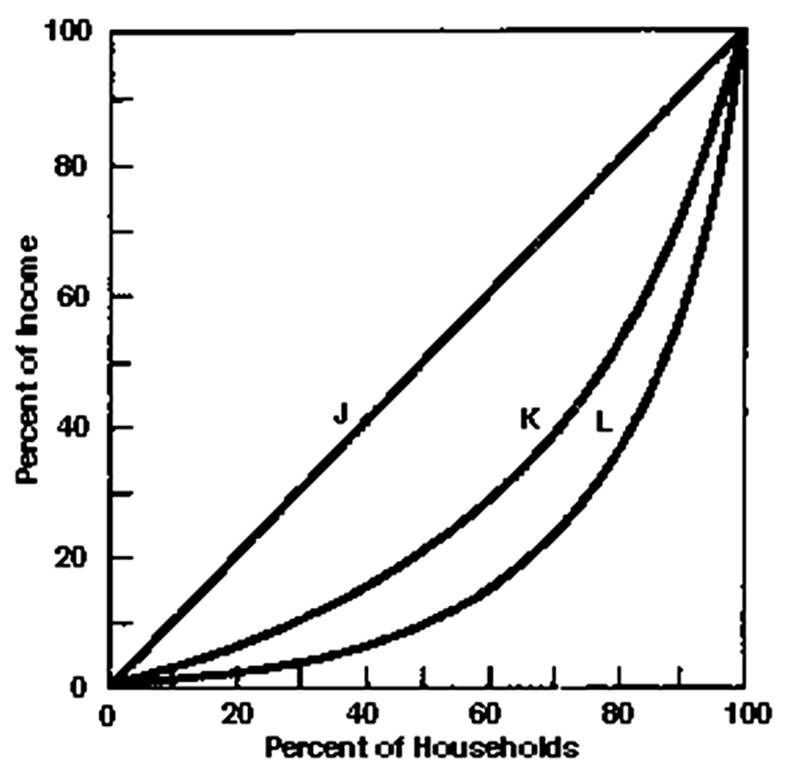

What is the percentage of income received by the upper two quintiles on line K?

A relatively flat demand curve indicates that

a. quantity demanded will adjust only slightly to a price change. b. quantity demanded will adjust significantly to a price change. c. quantity demanded will not adjust to a price change. d. the change in quantity demanded will exactly equal a change in price.