CarryALL, Inc., makes and sells small cargo trailers to individuals and small businesses. Since its opening in 1990, it has allocated indirect costs (IDC) to its three manufacturing plants based on direct materials cost per unit. Each plant builds different models and sizes. Because of advances in automation and materials, Judy, the CFO, plans to use build-time per unit as the new basis. Build-time is the average number of work-hours to complete a trailer. However, she initially wants to determine what the allocation would have been this year had the build-time basis been used prior to the incorporation of new technology and materials. The data shown below represents average costs and times. Use this data and the bases indicated to determine the allocation rates and IDC

allocation of $1,000,000 for this year for the three bases.

FIGURE 1.png)

Determine the rates by basis, then distribute the $1,000,000

FIGURE 4.png)

Example allocation for New York:

Direct material cost: 19.49(20,000) = $389,800

Previous build time: 716.85(400) = $286,740

New build time: 793.65(425) = $337,301

ANSWER.png)

You might also like to view...

What are the threadlike molecules of DNA that make up the chromosomes called?

What will be an ideal response?

A structural subcomponent using the triangle shape is rarely used in structural design because of its inherent instability.

Answer the following statement true (T) or false (F)

List the three power supplies that may be used to operate nail guns.__________________________________________________________________________________________

What will be an ideal response?

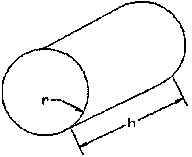

Cylinder![]()

Carry the answer to two decimal places.What is the value of h required to enclose 10,000 cubic inches if the tank is 18" across? Your answer should be to the nearest inch but not allow less than 10,000 cubic inches.

Carry the answer to two decimal places.What is the value of h required to enclose 10,000 cubic inches if the tank is 18" across? Your answer should be to the nearest inch but not allow less than 10,000 cubic inches.

Fill in the blank(s) with the appropriate word(s).