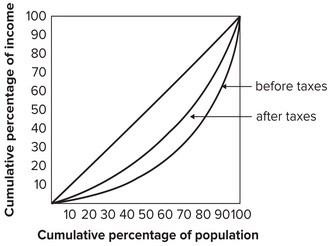

Refer to the graph shown. A possible explanation for the difference between the distribution of income before taxes and the distribution of income after taxes shown in the graph is that the tax system:

A possible explanation for the difference between the distribution of income before taxes and the distribution of income after taxes shown in the graph is that the tax system:

A. is progressive.

B. is proportional.

C. is regressive.

D. does not affect income inequality.

Answer: A

You might also like to view...

If the real interest rate is 8 percent and the inflation rate is 2.5 percent, then the nominal interest rate is

A) 8 percent. B) 10.5 percent. C) 3.2 percent. D) 2.5 percent. E) 5.5 percent.

Consider two individuals, Kevin and Harris, who discount delayed utilities with a weight of 1/2 and 3/4, respectively

a) Who between the two individuals gives more weight to things that happen in the future? b) If consuming ice cream gives both Kevin and Harris benefits worth 8 utils instantly and has delayed costs of 15 utils, then comment on whether both individuals will want to consume ice cream. c) If the nearby ice cream parlor is closed for a week, will Kevin and Harris prefer to eat ice cream after a week, given that they have to decide today?

Why is portfolio diversification so important in international trade?

What will be an ideal response?

To maximize expected profit, a perfectly competitive firm with a random marginal cost and random demand should produce at the level that sets ________ equal to ________.

A) expected marginal revenue; marginal cost B) marginal revenue; expected marginal cost C) expected marginal revenue; expected marginal cost D) marginal revenue; marginal cost